The situation of Vietnamese private enterprises facing the 46% tax of the US

The situation of Vietnamese private enterprises facing the 46% tax of the US is alarming, especially for key export industries. Here are some detailed analysis: direct impact on key industries

- Textiles and footwear: Accounting for 13.5% of the export turnover to the US of 16.1 billion USD in 2024, many enterprises such as Song Hong Garment MSH, Thanh Cong TCM face the risk of losing orders due to a 30-40% increase in prices. Viet Thang Jean Company expects a 35% decrease in revenue if the tax is maintained, forcing it to shift to the EU and Japan.

- Aquaculture : Vinh Hoan (VHC) and Minh Phu MPC – two “big guys” exporting shrimp and pangasius – may lose 50% of their market share in the US due to their products becoming more expensive than Indonesia and India.

- Electronics and components : The group accounts for 19.4% of exports of 23.2 billion USD) and is heavily affected. SHDC, a company specializing in manufacturing phone chargers, said it “cannot survive” if the tax is applied, leading to the risk of bankruptcy.

Business response

- Market shift: Many businesses are increasing exports to the EU, South Korea and ASEAN, even though profits are 15-20% lower than in the US.

- Transparency of raw materials: Textile and garment companies are actively proving that the origin of raw materials is not from China to negotiate tax reductions.

- Cost reduction: Optimize production, reduce 10-15% of workers and switch to automated production lines.

Overall challenges

- Employment: An estimated 500,000 workers in the textile and garment and electronics industries are at risk of losing their jobs if the tax is extended for 6 months.

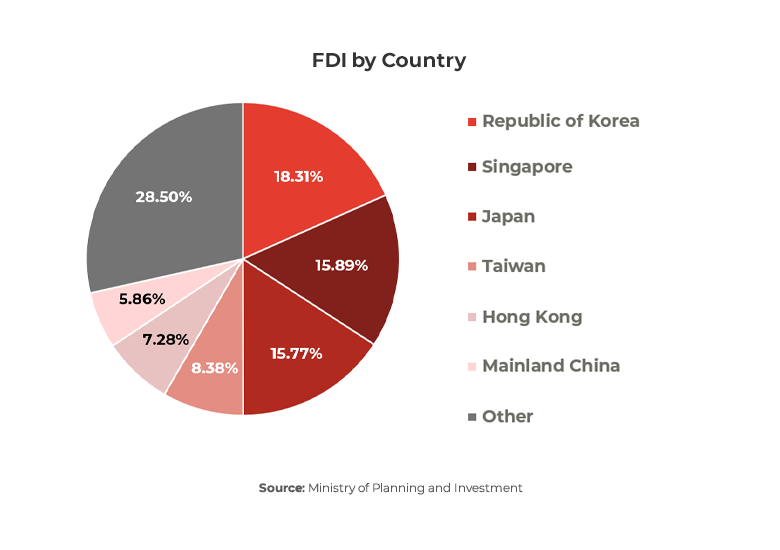

- FDI inflows: Foreign investors such as Samsung and LG are considering reducing 20-30% of their capacity in Vietnam and shifting to India and Mexico. 3

- Stock market: Export stocks (VHC, TNG, MSH) decreased in value by 15-25%

Although the government is negotiating to extend the tax period until July 9, 2025, businesses need to:

- Diversify markets, take advantage of EVFTA and CPTPP.

- Invest in technology to increase added value, reduce dependence on processing.

- Form a domestic supply chain for raw materials, avoid risks from US-China tensions

The 46% tax rate puts Vietnamese private enterprises in a “life and death” situation, requiring both short-term strategies (changing markets) and long-term strategies (improving competitiveness) to survive in the new context.

Share this article

Follow us

13 Comments

discount androxal usa sales

ordering androxal online without a prescription

ordering enclomiphene generic drug india

purchase enclomiphene cheap genuine

ordering rifaximin generic overnight delivery

how to order rifaximin cost of tablet

online order xifaxan buy online australia

discount xifaxan purchase toronto

discount staxyn cheap prices

cheapest buy staxyn purchase to canada

purchase avodart generic is it legal

purchase avodart generic canada no prescription

cheap dutasteride cheap online pharmacy

ordering dutasteride cheap pharmacy

buy flexeril cyclobenzaprine purchase uk

flexeril cyclobenzaprine no prescription overnight cod delivery

gabapentin perscription from s online

get gabapentin buy san francisco

Cheap fildena no perscription

get fildena australia to buy

buying itraconazole purchase online uk

generic itraconazole singapore

kamagra žádný skript potřebný přes noc

kanadská lékárna bez lékařského předpisu kamagra

medicament kamagra beau prix pas

medicament kamagra gracieux